In the past ten years, digital currency has gradually known by the public while its influence has become wider and wider. In the development history of digital currency, supervision has always been a focused and necessary topic.

In April this year, a local court in Shenzhen, China determined in a cryptocurrency theft case that Ethereum is legal property with economic value. Although Ethereum cannot be circulated as currency in China, it is a virtual property and its owner can manage the currency held, and they are able to make payments and transfers in a specific way and trade with currency in public, which is explicitly referred to in the judgment. It has certain economic value and belongs to the “property” according to criminal law.

It means that digital currency is legal asset and protected by the Criminal Law that the public can hold and trade although ICO and other financing acts are prohibited in China.

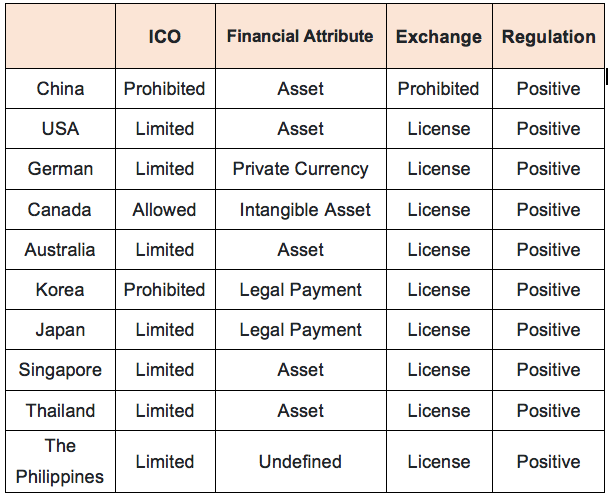

Regulation and policy about cryptocurrency are various all over the world. As blockchain technology is highly focused, ICO and related financing acts are also strictly monitored.

In terms of transaction, most countries utilize licenses for industry supervision: US states have adopted positive measures for digital currency. Under the regulations of the Securities Regulatory Commission, transaction-related businesses can be carried out under the premise of obtaining licenses; Japan has incorporated digital currency into the law. Exchanges are subject to full-scale supervision; Thailand has also enacted laws to regulate exchanges; the Central Bank of the Philippines issued exchange licenses in 2019; and the Monetary Authority of Singapore (MAS) officially announced a list of exempt enterprises for Payment Service Act(PSA) license.

In terms of attribute definition, it varies: In August 2013, the German government officially recognized Bitcoin as legal currency and Bitcoin can be used for tax payment or other purposes; Digital currency is defined as asset and it is distinguished from fiat money (Ruble) according to Russia “Digital Currency Asset Law”; In 2017, Australia announced that digital currency is not a monetary asset, but an electronic representation of value; Japan also revised the “Japan Payment Service” in 2017 that Bitcoin is a payment method like a certain currency…

Regardless of the current trend, the gradual release of policies by various governments will promote the compliance of digital currency or digital asset industry. DALICHAIN is also actively following the policy trend, and constantly promoting the blockchain application and development on the premise of legal compliance.